So, you’re in your 40s now. You’ve got some solid life experience under your belt, but you’re not ready to coast into retirement just yet. Your finances might be in okay shape, but you know you could be doing more to set yourself up for true financial freedom in the years ahead.

The decisions you make now will have an enormous impact on your 50s, 60s, and beyond. The good news is it’s not too late to correct the course. With some smart strategic moves, you can improve your financial freedom and put your future self in a much better position.

Read on for tips and advice on maximizing your income, managing debt, growing your savings, and investing wisely so you can gain financial freedom and flexibility as you enter your later years. Small steps today can lead to big payoffs down the road.

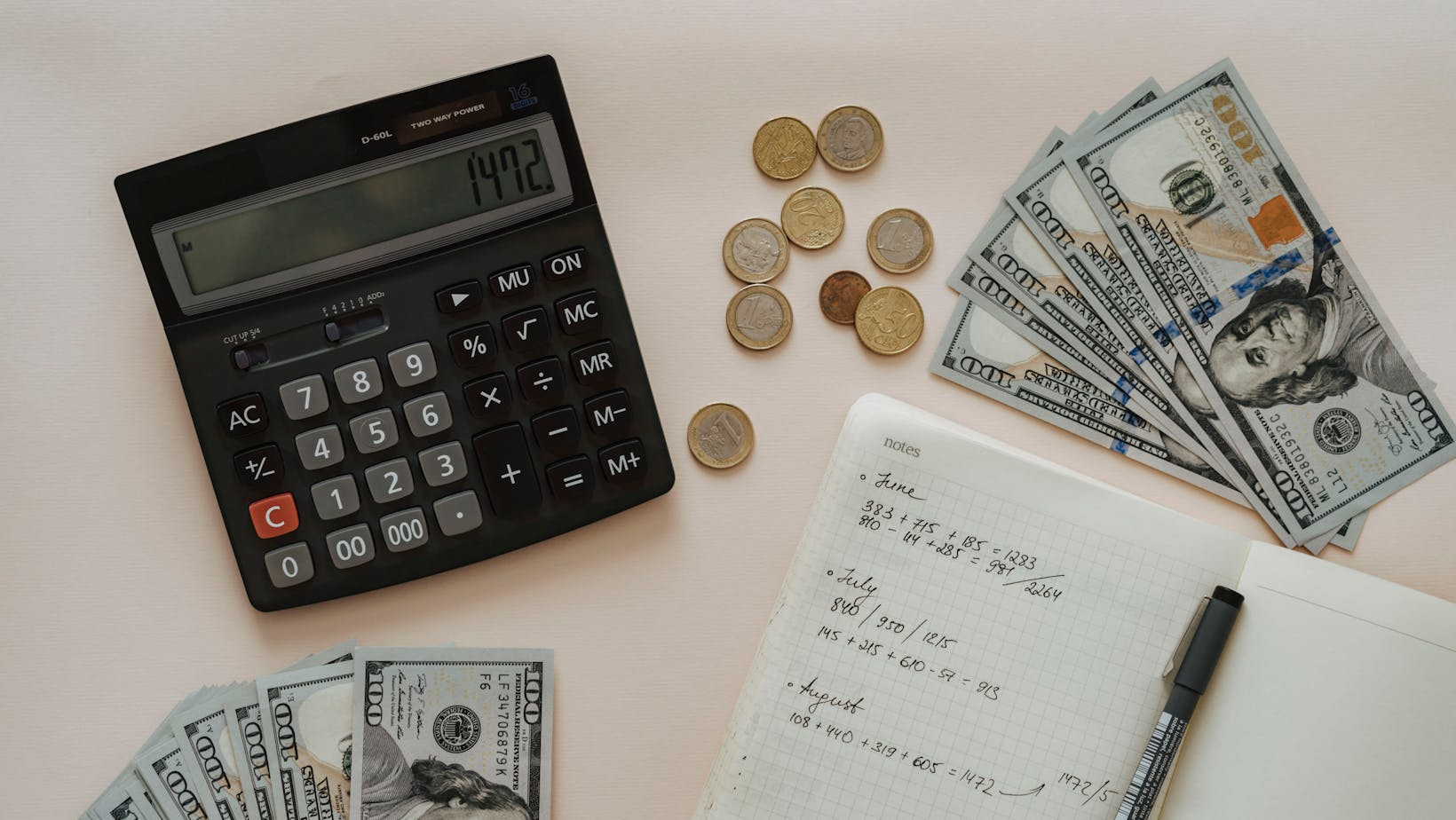

Do a Financial Checkup in Your 40s

Take a close look at how much you’re bringing in and how much is going out each month. See if there are any expenses you can reduce or eliminate, like eating out or entertainment costs. Even small changes can make a big difference over time.

If you haven’t already, now is the time to start contributing enough to get any matching from your employer. Look at your investment allocations and make sure your money is working as hard as possible for your future. Consider meeting with a financial advisor to make sure you’re on the right track.

Your needs for life, health, home, and auto insurance change over time. Shop around to make sure you have the right coverage at a good price. You may be able to reduce premiums by increasing deductibles or reducing coverage on a paid-off vehicle. Make sure you understand what’s covered and not covered.

Increase Your Income in Your 40s

In your 40s, increasing your income typically means developing a side hustle. A side hustle is a way to make money outside of your regular job. One option is starting an OnlyFans account. OnlyFans allows creators to share photos and videos with subscribers for a monthly fee.

If you already have a following on social media, you can promote your OnlyFans account to quickly gain subscribers. You’ll want to post exclusive content that interests your followers.

Offer premium content on OnlyFans, and check out creators like the top ebony OnlyFans models for reference. Focus on providing premium photo and video content tailored to your audience’s interests. You might share workout tips, cooking demos, travel stories, or advice for your particular industry. Post 3-5 times per week to keep subscribers engaged. As your following grows, you can raise subscription rates. Top OnlyFans creators make over $100,000 per month!

While an OnlyFans side hustle may not be for everyone, it shows how, in your 40s, you have the life experience and skills to develop additional income streams and focus on other areas like web design, data entry, content writing, etc.

With time and consistency, a side hustle can grow into a lucrative venture. The key is finding one that leverages your talents, interests, and the value you can provide to others.

Optimize Your Spending and Savings in Your 40s

Once you hit your 40s, it’s time to get serious about improving your financial freedom. Start by reassessing how you’re spending and saving your money each month. Look for expenses you can trim or eliminate, like dining out or entertainment. Even small changes can add up to big savings over time.

If you don’t have a budget, make one. Track your income and expenses to see where your money is actually going each month. Look for expenses that seem high and see if you can reduce or cut them. Set limits for discretionary spending on things like hobbies, travel, or gifts. Hold yourself accountable to your budget each month to make progress toward your goals.

Get Your Finances in Order

You’re never too old to start getting your finances in order. Even if you feel behind on retirement savings or have debt hanging over your head, your 40s are a great time to correct your situation. Start by looking closely at your spending habits and see where you can trim the fat.

Commit to an automatic transfer from your paycheck to a retirement account, even if it’s a small amount at first. Meet with a financial advisor to map out a plan. Read up on ways to eliminate debt faster. Small steps add up over time. With some discipline now, your 50s and beyond can be filled with financial freedom and peace of mind. The time is now to take control and set yourself up for a secure future.